Investigators have always known that ‘following the money’ can provide significant amounts of intelligence. And financial investigators as industry have formalised the process and implemented techniques to uncover the interesting and useful things that exists in financial data.

Jonathan Dryer, Intelligence Analyst at Oculus Financial Intelligence outlines how FACT360 is used on a day-to-day basis and the practical benefits it delivers.

Can you outline the role of the financial investigator?

We can work wherever it is thought there has been financial impropriety and Oculus has conducted investigations uncovering fraud, fraudulent misrepresentation, money laundering, concealment of assets, theft and financial markets abuses. In these types of projects we are finding the intelligence that could either be used as litigation support or to support a criminal trial so we are typically working with barristers or solicitors, regulatory bodies and companies in the financial sector.

However, as much time as we spend investigating alleged wrong doings, our investigations could equally be part of the due diligence process during a company acquisition or other financial deal.

How do you use FACT360?

When I start an investigation there is a lot of information to sift through. There is likely to be thousands of emails, messages, pdfs, voice recordings, bank statements and the challenge is always identifying what is important. It is also vital to manage the data in a way that means it is useful and, in the case of criminal trials, legally admissible.

…the first step in the process

FACT360 is the first step in the process and whatever corpus of data we have, FACT360 puts it into a manageable format so it can be interrogated.

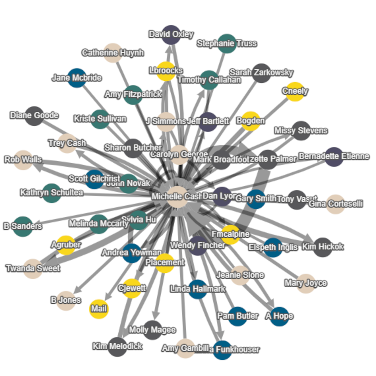

A standard methodology in any investigation is to develop a network diagram showing the key individuals and how they are related to others in the network. There is good software on the market that helps create the network but it is quite a laborious process with each individual and relationship added to the network manually. Because FACT360 produces a network diagram automatically, the first thing you see when running an analysis is who the key people are and who they are communicating with.

FACT360 really makes the story jump out

The network diagram is useful in its own right, but what sets FACT360 apart is its ability to automatically identify the key topics within the set of documents or messages. Immediately we can see any common themes and you know where to start your investigation. This is where FACT360 starts to help us turn information into intelligence and it is easy to see any linked individuals and communication or documents.

FACT360 really makes the story jump out and makes the ‘understanding’ phase of the investigation much faster. Something that could have taken two weeks can be done in a matter of hours.

Traditional investigations are reliant on the investigator’s knowledge and experience. And while this sounds obvious and to a certain extent desirable it also means they are also affected by the individual’s biases. The technology behind FACT360 removes any individual bias and presents the facts – it also means any searches we do are consistent and repeatable.

At a practical level, FACT360 is incredibly useful when it comes to producing reports or briefing people during an investigation. It happens regularly that senior members of the legal team who will not be dealing with the investigation on a day-to-day basis will need a summary report and the FACT360 dashboards make it simple to show key individuals, documents and timings.

What would you say was FACT360’s key strength for financial investigation?

A key part of FACT360 is that it can find the unusual activity and documents. It is often these moments that provide a rich vein of intelligence, so it is incredibly useful to effectively have large flags stuck in the data showing where to start looking.

Strip out relevant information from unstructured data

The fact that FACT360 can strip out the relevant information from unstructured data also makes it very powerful. For example, it doesn’t need bank details to be nicely formatted in individual cells of a spreadsheet and if the details are mentioned anywhere in a document it can find them.

How does FACT360 help with Early Case Assessment?

With a traditional eDiscovery platform we may upload 100k emails and manually searching will help us identify 10k emails that need to be assessed by our team of analysts. It is an incredibly time-consuming process and

data storage costs makes it very expensive. FACT360 does it the other way round and takes our 100k emails and helps us identify the relevant 10k emails that we upload to our eDiscovery platform. Our eDiscovery costs are immediately slashed and we are only spending our time on the relevant documents.

eDiscovery costs are immediately slashed

Scoping projects is also much faster and much more accurate now. This saves our clients money because we are spending much less time working out exactly what the project is likely to entail and because we can allocate resources more accurately, we have a much more accurate estimate of total costs.

What’s the best thing for you personally about using FACT360?

On a personal level what I like about using FACT360 is that means I spend more of my time on what I enjoy which is investigating. It significantly reduces the laborious administrative tasks and the dashboards mean you can really dig into the data to find the key evidence. It’s worth remembering that FACT360 is only a tool and the financial investigator still has the final say on what is relevant.

If you you would like to learn more about how Oculus worked with FACT360 during an investigation into market manipulation, sign up to our FREE webinar on 25 May 2021 – Click here for more details.

FACT360 for Financial Investigators

- Network diagram of key individuals and communication generated automatically.

- Bias free analysis.

- Unusual behaviour flagged automatically

- ‘Understanding’ phase of investigation reduced from weeks to hours.

- Slash eDiscovery costs by only processing relevant data.

About Oculus Financial Intelligence

Oculus is a specialist financial intelligence service provider fusing financial, intelligence and legal skills to provide targeted, detailed and actionable insights.

With a unique team of international experts, Oculus conducts investigations to help its clients improve investment returns, protect and recover investments and assets, mitigate financial risk and investigate financial crimes.

About FACT360

FACT360 is a UK company pioneering the use of AI and unsupervised Machine Learning to help organisations find critical information that exists within their communication flows.

Established in 2017, FACT360’s solutions are widely used in fraud and insider threat investigations and it also applies its technology more broadly providing businesses with fact-based rationale on which to take strategic decisions.